Christoph Jäckel's blog

Code repository for publicly available finance data

Repository of R functions and code to obtain publicly available financial data from various sources

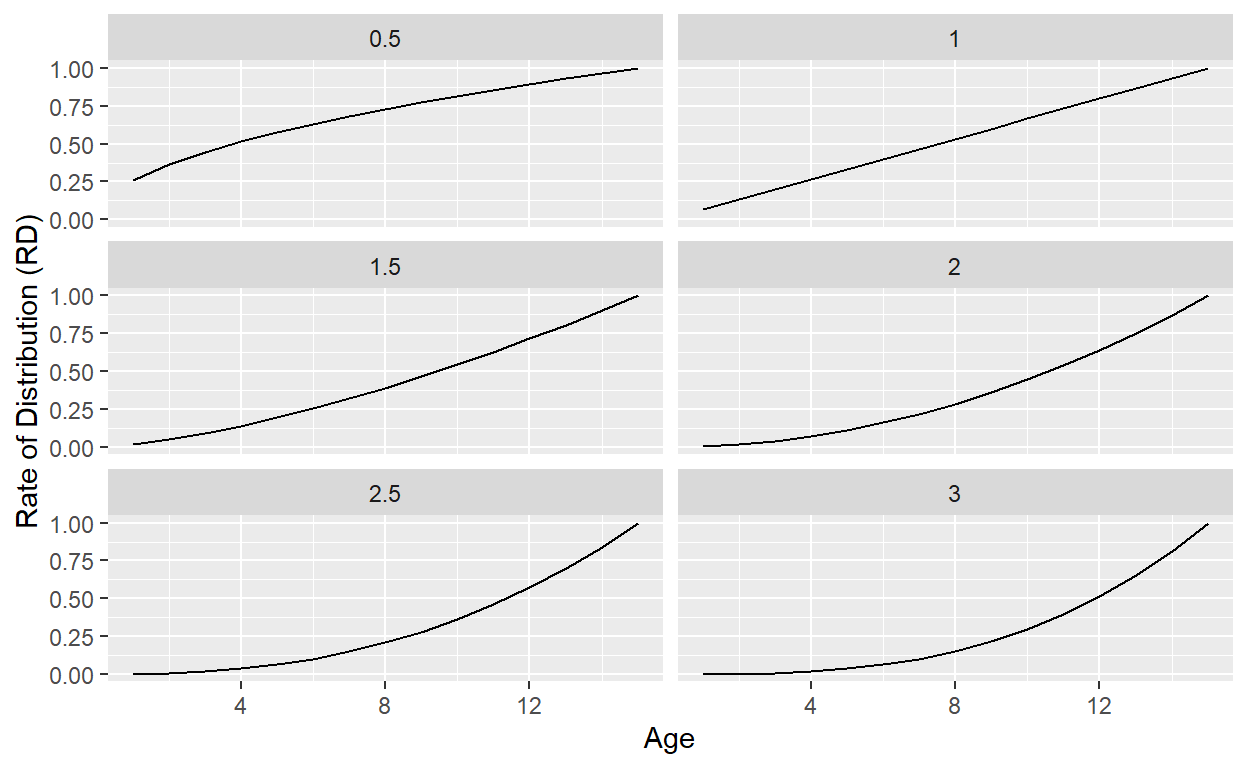

The Takahashi and Alexander model

A brief introduction to the Takahashi and Alexander (TA) model for private equity fund cash flows and how to implement it in R.

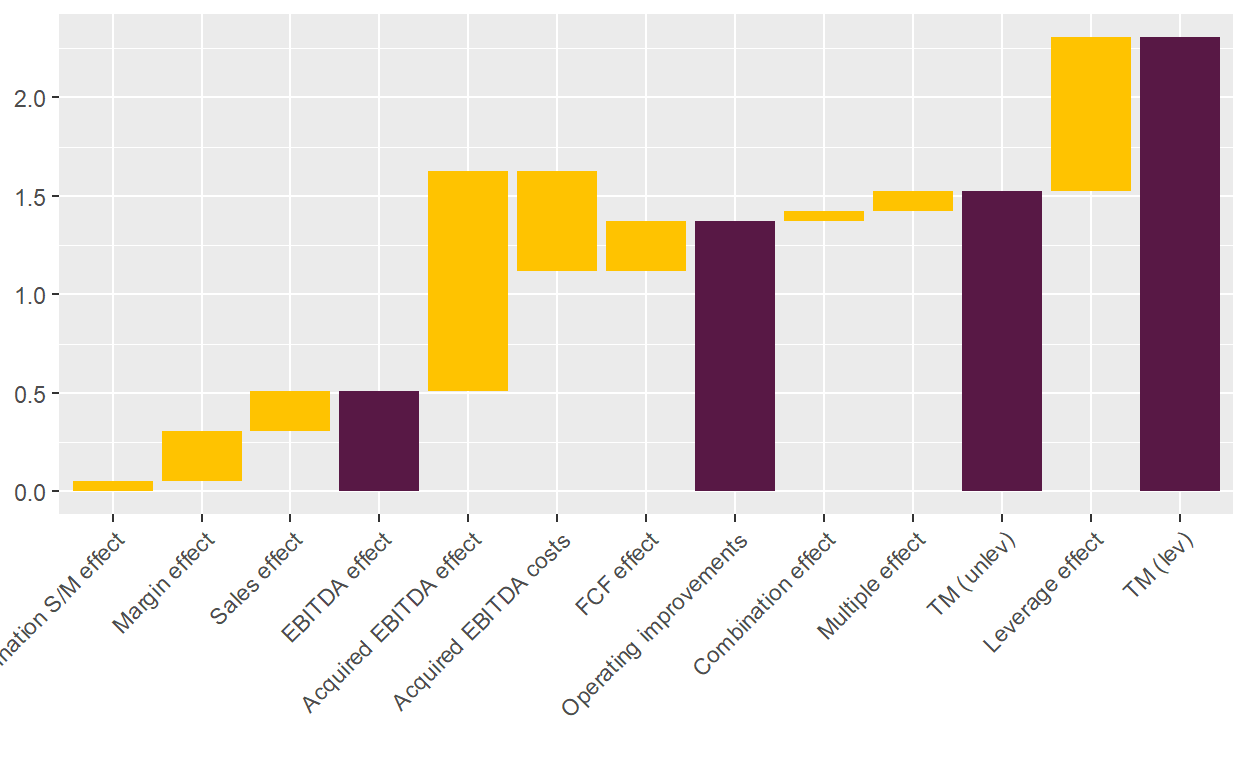

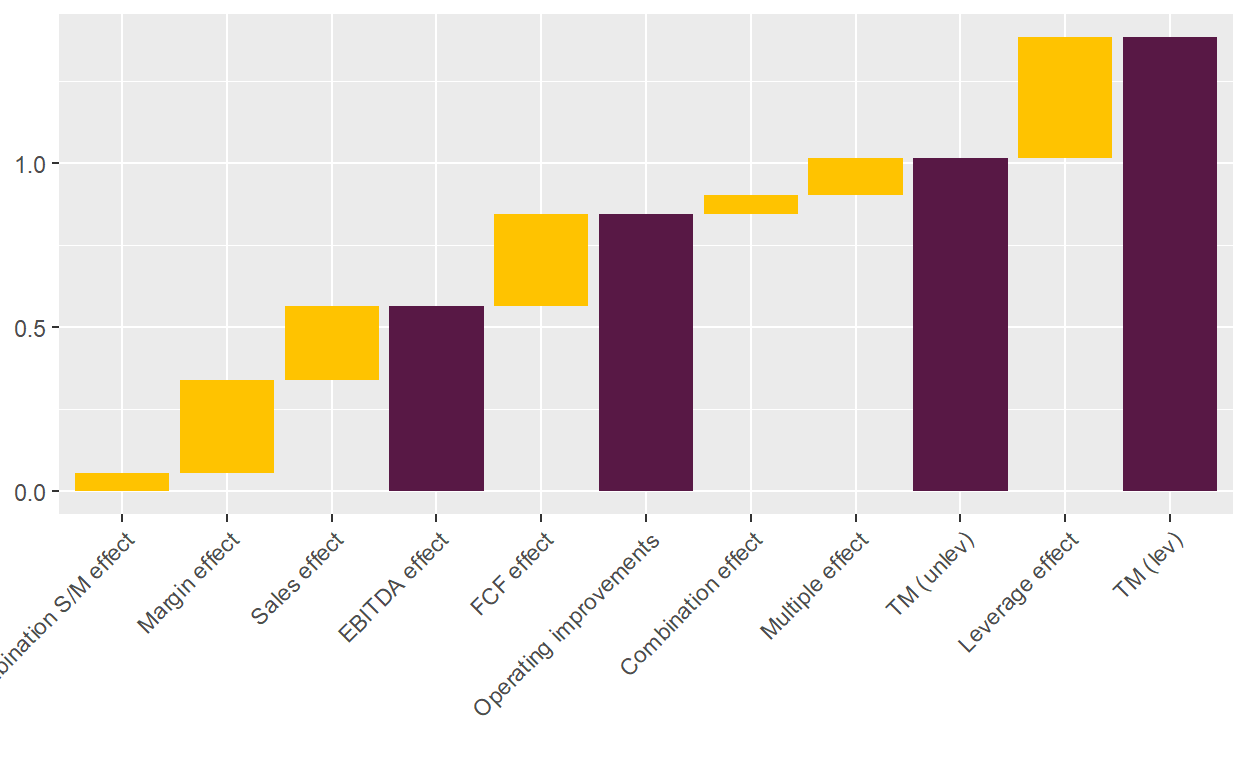

The LBO value bridge - revisited

Some additional thoughts about the LBO value bridge.

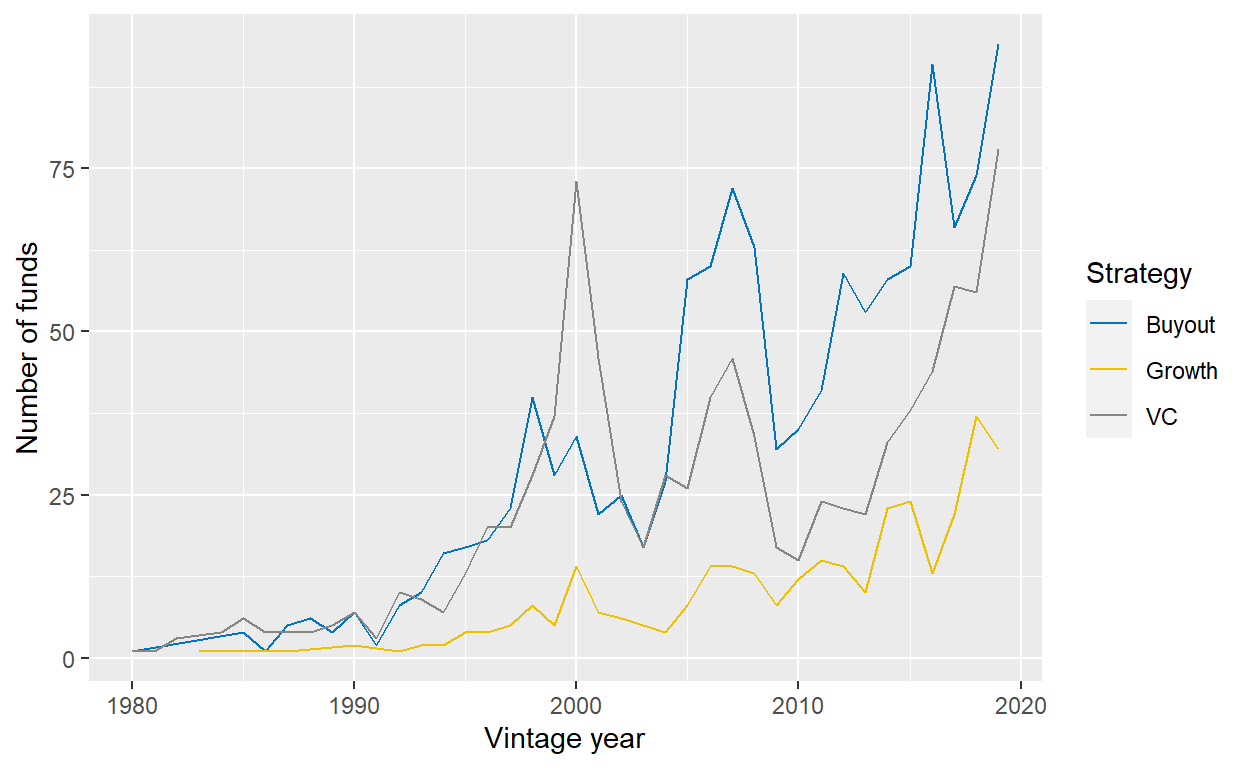

Insights from Burgiss holdings data

A short review of Brown et al. (2020) with a few intriguing statistics.

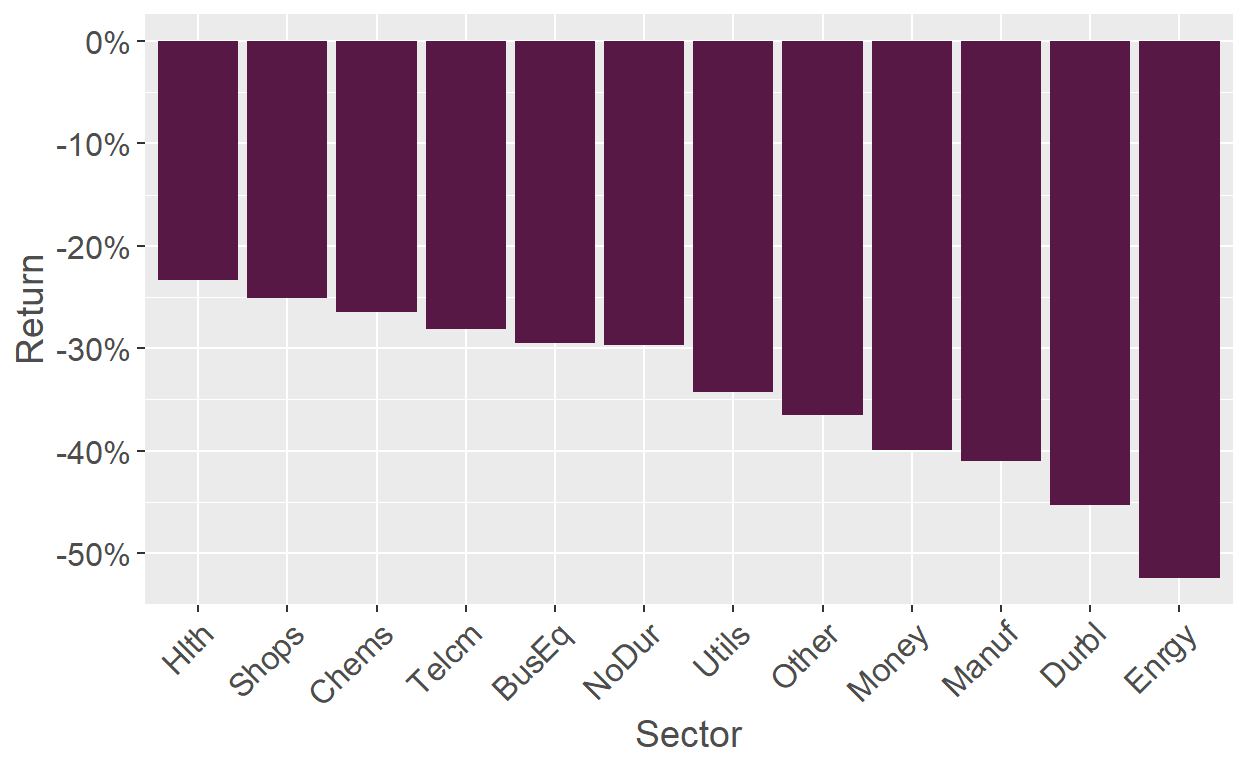

Sector performance

How to use data from Kenneth French and Aswath Damodaran to understand the impact of macroeconomic events on certain sectors.

The ultimate guide to private equity performance

A thorough analysis of the performance of the asset class private equity.

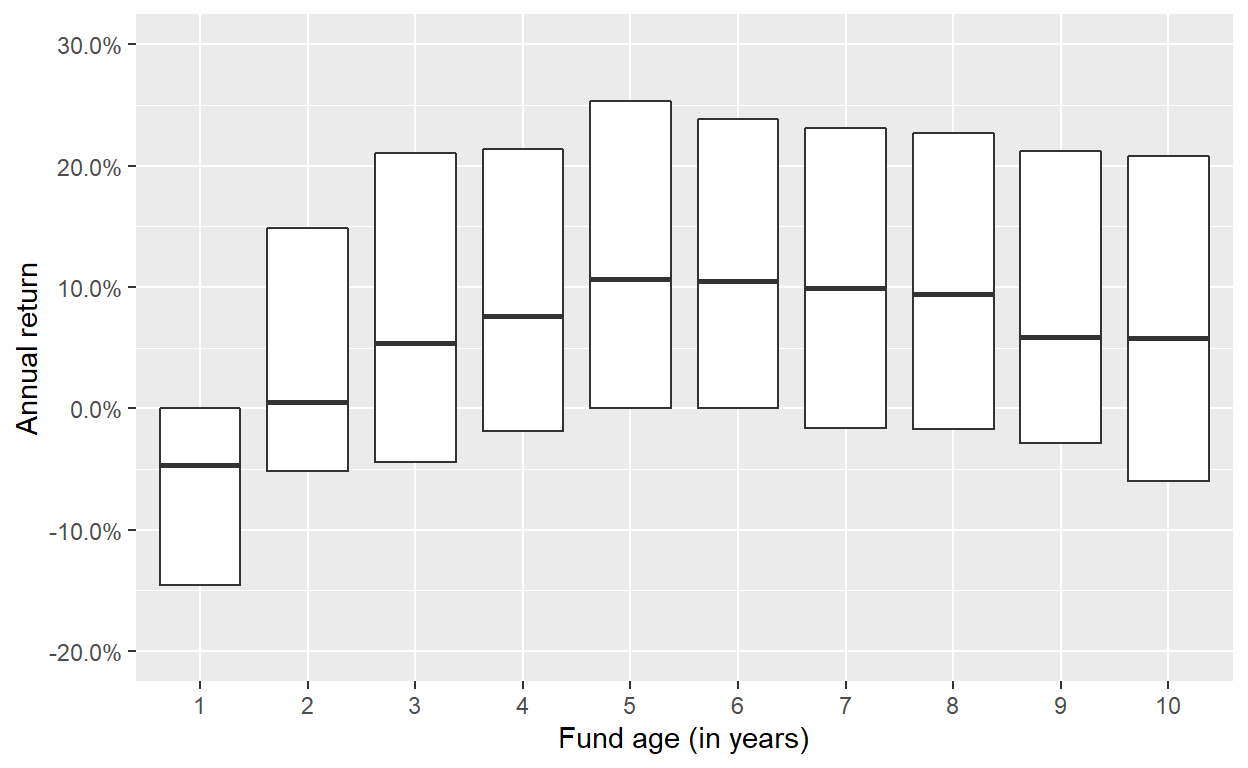

Value creation of a private equity fund over time

When does a private equity fund generate most of its value?

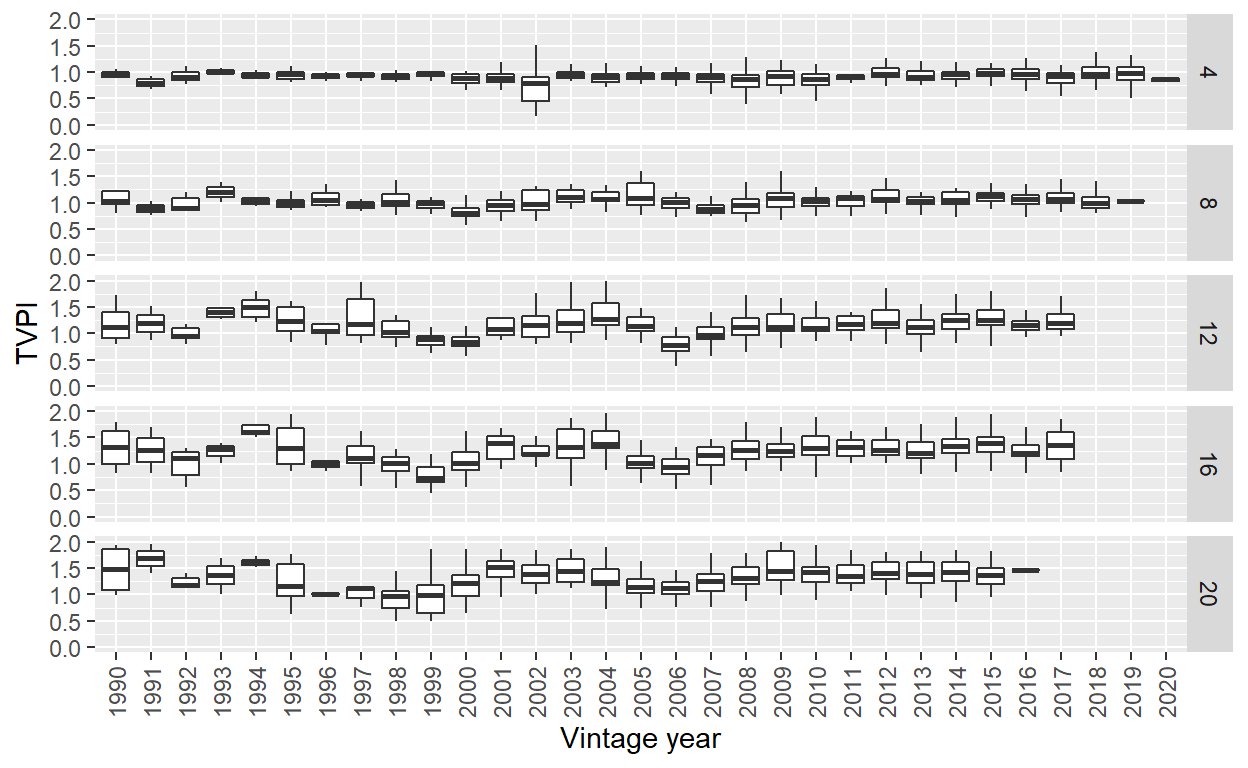

Do managers mark up their funds more aggressively?

If they do, a comparison of the unrealized performance over vintage years might be meaningless.

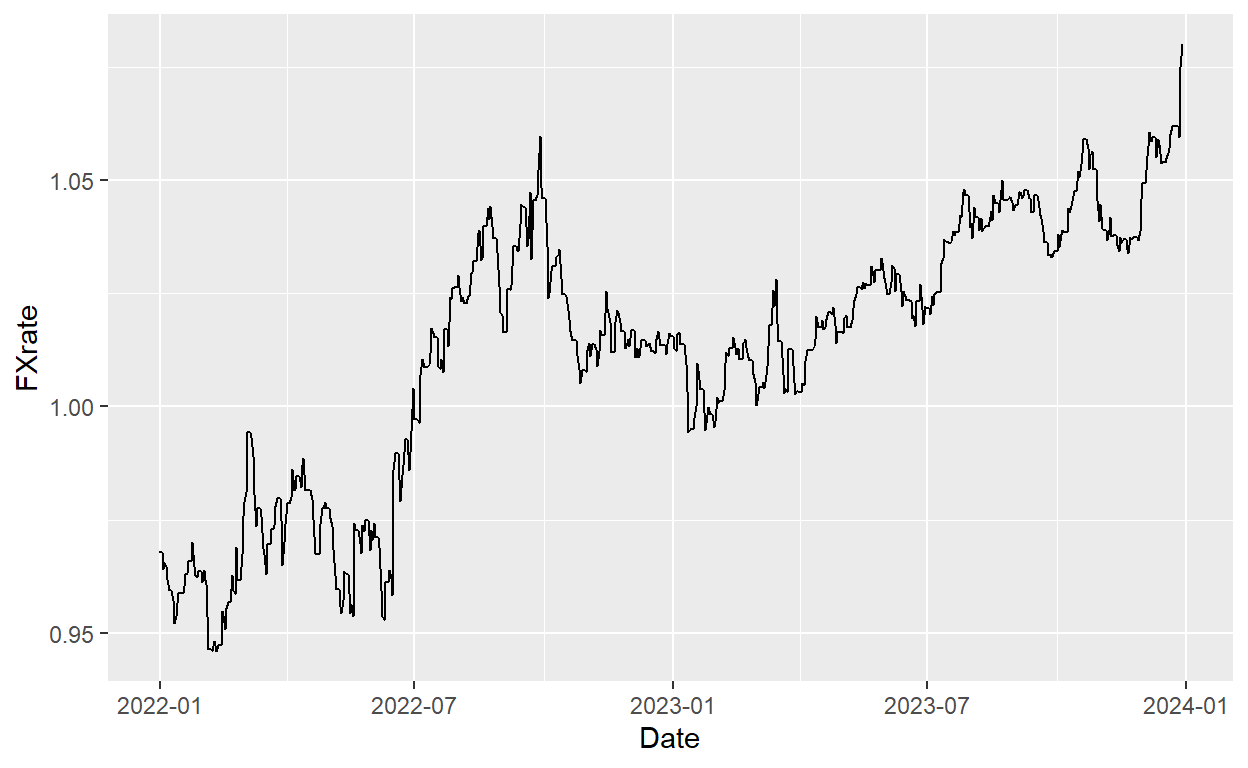

Closing process of a secondary transaction

How to get from the base purchase price to the final purchase price.

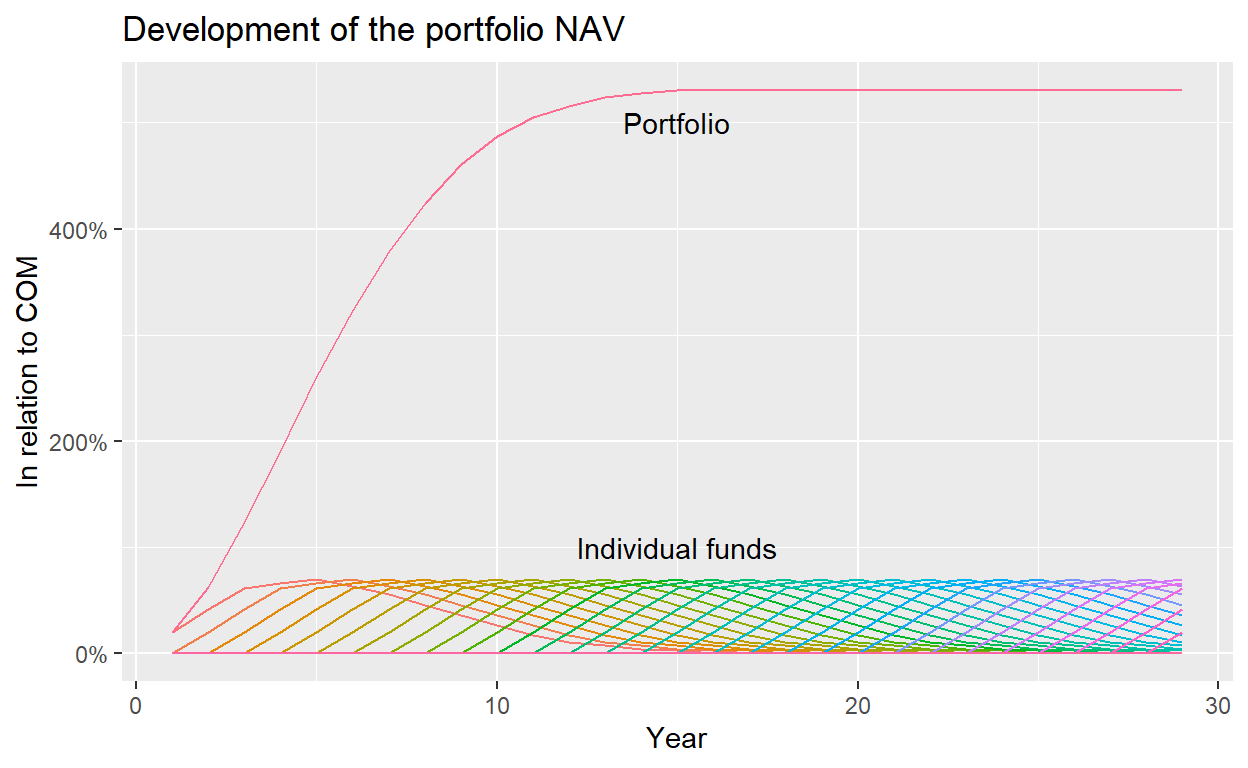

How to get to the private equity target allocation

A simple heuristic to help investors understand how to get to and maintain a target allocation in private equity. In a nutshell: steady state is your friend.

Why does private equity outperform public equity?

According to recent studies, it's a combination of selection skills and leverage.

The LBO value bridge

One of the most important valuation tools in private equity.

EV/EBITDA valuation multiple: some data

A closer empirical look at the EV/EBITDA multiple.

EV/EBITDA valuation multiple: the theory

How to justify the use of EV/EBITDA valuation multiples with the discounted cash flow model.

Automatically obtaining data from Damodaran's website with R

A quick tutorial on how to obtain data automatically from Damodaran's website with R.